Groupe BPCE has little exposure (1) to Russia and Ukraine

Groupe BPCE is following developments in the situation in Russia and Ukraine very closely, even though its exposure1 to these two countries is very limited.

The Group strictly complies with the regulations in force and diligently implements the necessary measures to strictly apply, as soon as they are published, international sanctions.

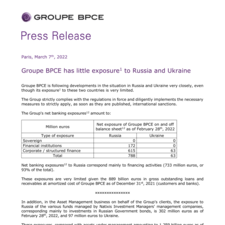

The Group's net banking exposures[1]2 amount to:

|

Million euros |

Net exposure of Groupe BPCE on and off balance sheet1[2] as of February 28th, 2022 |

|

|

Type of exposure |

Russia |

Ukraine |

|

Sovereign |

0 |

0 |

|

Financial institutions |

172 |

0 |

|

Corporate / structured finance |

615 |

63 |

|

Total |

788 |

63 |

Net banking exposures12 to Russia correspond mainly to financing activities (733 million euros, or 93% of the total).

These exposures are very limited given the 889 billion euros in gross outstanding loans and receivables at amortized cost of Groupe BPCE as of December 31st, 2021 (customers and banks).

¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤

In addition, in the Asset Management business on behalf of the Group's clients, the exposure to Russia of the various funds managed by Natixis Investment Managers' management companies, corresponding mainly to investments in Russian Government bonds, is 302 million euros as of February 28th, 2022, and 97 million euros to Ukraine.

These exposures, compared with assets under management amounting to 1,259 billion euros as of December 31, 2021, are very insignificant.

Footnotes